Shyamal elucidates that neoclassical economics generalised classical doctrines, focusing on broader economic impact. However, state intervention for political gains now challenges growth-focused policies, exclusively for Different Truths.

During recent years, the majority of the significant and outstanding developments in economic thought and applications have been brought through neoclassical concepts. Classical economists primarily dealt with contemporary economies, with a focus on prevailing market and price systems and fluctuations thereof. It is in the neoclassical phase of the economic outlook that attempts have been made to generalise doctrines and principles for a broader perspective of its impact.

To put it simply, Ricardo’s idea of rent was affiliated with the feudal character of land ownership as prevailing in the later medieval society, whereas the neoclassical concept of rent as income earned by a factor of production over cost to deployment or income over its opportunity cost is common for any social setup. It is a different matter while pursuing generality neoclassical ideas invoke hypothesis or abstraction far from social reality—also many times warranting modification to analyse social changes. As found in the idea of quasi-rent introduced by Marshall.

Changed Dynamics of Economic Theory

Much water has flown since then in the Ganges, and enough of the economic Chalisas have been read by different schools to tame the crisis. Whereas the early proponents of economic thought, be it classical or neoclassical, assumed or proposed their findings referring to a given set of socio-political systems and market forces facilitating hypothesis-specific. The role of the State or its agencies with the emergence of the stock market as well as tariff-regulated international business changed the dynamics of economic theory in modern times.

While the economists have been engaged to formulate analytical principles determining varied movements and fluctuations of economic cycles for growth, the state attempts to impose variants as suited to its estimates for development, notwithstanding at times flagging notes of monetary authority. Very recently in our country, we have witnessed an issue with bank rates. A cut in bank rate does in no way make the economy propel ahead; rather, such a step may adversely disturb social engineering. Added to it, the impact of crony capital should not be overlooked.

Political Compulsions

State interference in economic decisions comes out mostly of political compulsions, and for a cure to an ailment in the economy, such acts may create deterrents, as evident in our neighbouring nations. It’s an academic debate on the extent of state-imposed sanctions beneficial to economic growth when most of the socialist economy fell into chaos. Of course, the free market idea of neoclassical theorists free of any intervention to attain Paretian economic stability may not be the real state of affairs. Leaving social welfare compulsions, influencing monetary controls by the ruling dispensation, albeit the State foretells conflict with the competent authority of regulation and resulting blockade for economic navigation.

Following Adam Smith, it is not from the benevolence of the State power that we expect prosperity but from their regard for their interest, i.e., to hang on to power. A very recent study on `State Finances- study of budgets 2024-25` from R.B.I. identifies benevolence through subsidies as becoming a stress point for the state exchequer. When any smaller state like Chattishgarh doles out nearly Rs. 10000 cr. annually for Matahri yojana and electricity subsidy; Uttarakhand to the extent Rs. 200 cr. on Girls yojana and electricity LPG subsidy—the entire outlay of the country summing up a mammoth share of public money on vote charity. There does not exist any public policy economics to justify except state benevolence for the vote-bank politics creating citizenry dependent on dole. Few Latin American states made such schemes, but except for short-term political gains, the economy eventually derailed.

In our country, the time has come to choose if the economic policy is based on growth and development matrix or political dynamics.

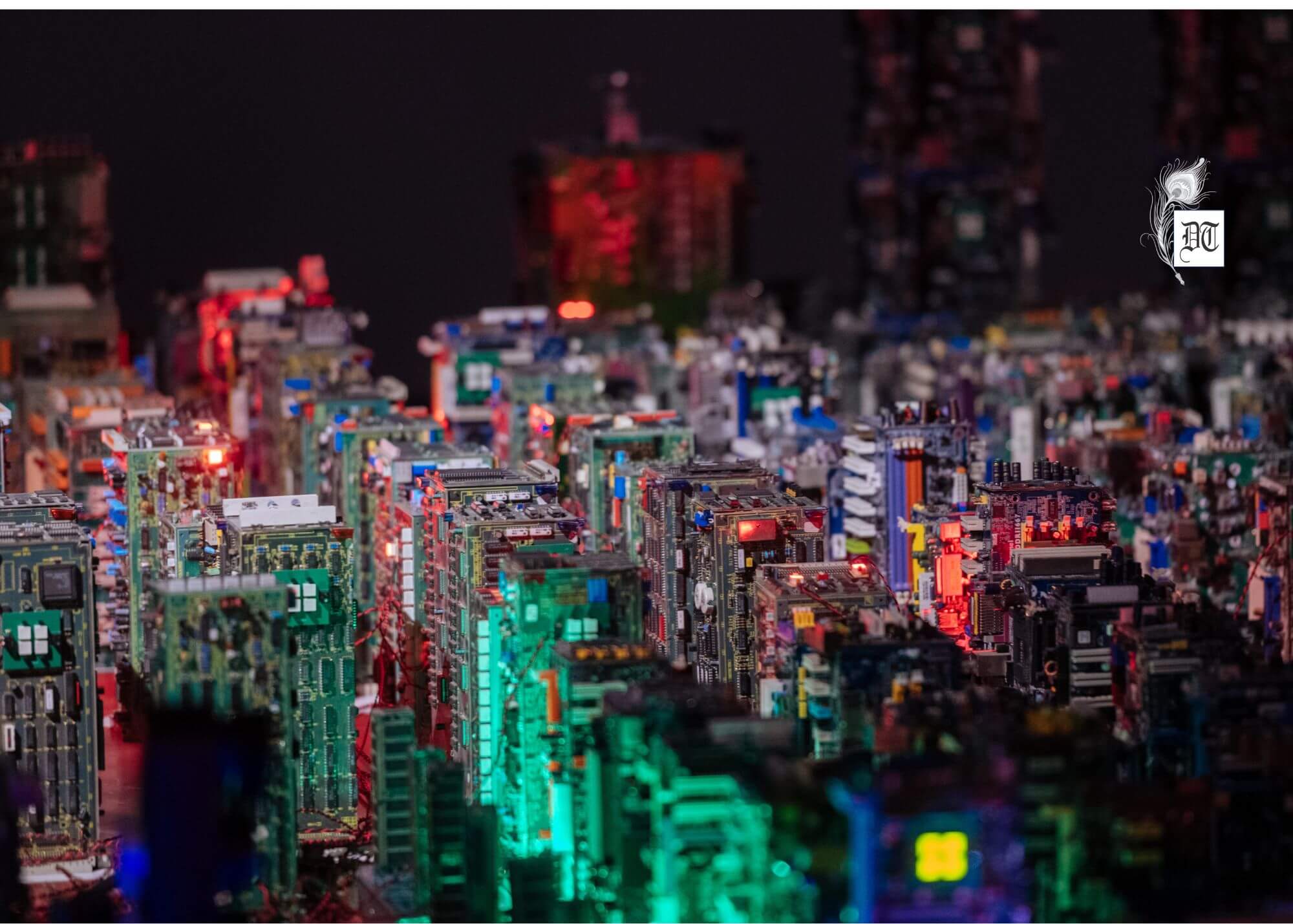

Picture design by Anumita Roy

By

By

By

By

By

By

By

By