In the aftermath of the scam, the Punjab National Bank’s honcho has claimed that it has acted promptly, suspending 10 officials, while the Central Bureau of Investigation has also booked a few officials of the bank that include one retired and one serving PNB employee so far. A report for Different Truths.

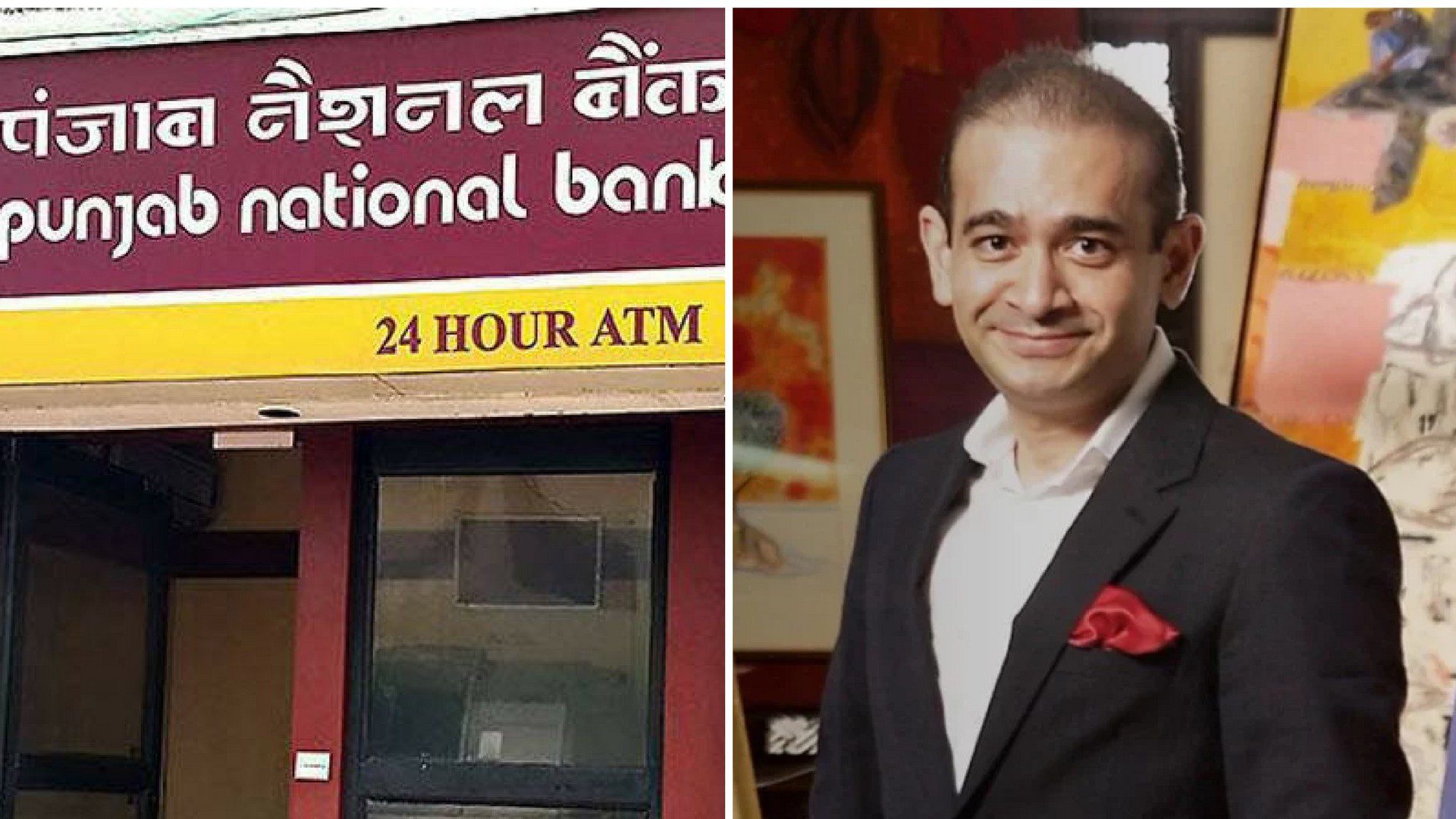

At a time when the country’s ailing banking industry, particularly the proverbial public sector banks (PSBs) suffering from balance sheet woes, is being bandaged by the first tranche of a capital infusion of Rs 88.139 crore as part of a jumbo Rs 2.11 lakh crore rescue package, the murky affairs in the country’s second-biggest bank, the Punjab National Bank of India (PNB), has surfaced to the dismay of the authorities. The gargantuan chicanery involving an 11,500 crore rupees smartly but silently executed by a maverick diamond merchant Nirav (silent!) Modi is a bespoke paradigm in the post-reform shenanigans of the banking industry that has but few parallels to besmirch the image of public sector institutions. It is also the worst happening to haunt the industry to demonstrate as to what light or feather touch regulation could spawn! One shudders at the mere thought of the revealed apathy of the internal auditors, statutory and concurrent auditors and on top of it all the regulator, the central bank which remained far removed from what was happening under their putative watch. As a perceptive analyst rightly put it in his column in a pink paper, the RBI has instituted inflation-targeting as its primary dharma to ensure sound money policy so that the people are spared from the worst form of taxation as inflation is billed but its continued wobbly way of supervisory role in ensuring sound banking is, to say the least, lamentable and worrisome. What is at stake is the financial stability of the system and if it is held hostage by a few errant and devious elements, none can save the economy when the chips are down, policy wonks wryly say.

In the aftermath of the scam, the bank’s honcho has claimed that it has acted promptly, suspending 10 officials, while the Central Bureau of Investigation has also booked a few officials of the bank that include one retired and one serving PNB employee so far. Soon after the break-out of the ill-tidings, the apex bank, which is also the regulator of the country’s banking sector, said in a press statement on Feb 16 that the fraud in PNB is “a case of operational risk arising on account of delinquent behavior by one or more employees of the bank and failure of internal controls”. The issue pertained to officials of Mumbai’s Brady House branch of PNB, who gave so-called letters of undertakings (LoU), basically guarantees, sans approvals, that enabled Modi’s diamond firms to raise credit from other banks. The overseas banks extended funds to Modi firms on the implicit understanding and assurance that PNB will fork out if there is a default. The messages on LoUs are routed through SWIFT (Society for Worldwide Inter-bank Financial Telecommunications).

It needs to be noted that all domestic banks are directed to mandatorily report their LoUs to RBI every quarter. In this case, what is less perspicuous but revealing after the nefarious designs had come to the fore as to whether PNB or its counterparties, i.e., overseas branches of Indian banks, virtually cold-shouldered their vital role to voluntarily comply with RBI direction. Industry insiders have disclosed on record that whenever a SWIFT message is sent, it is verified, checked and authorised at various checkpoints by the operations and treasury teams of the sender and receiver banks. Still, it seems no alarm bells were set ringing in this case.

Interestingly, PNB has contended that transactions and messages sent through SWIFT were not logged in its core banking system software, which normally logs quotidian transactions. This lapse has let the crooked employees escape the ‘not-eagle eyed’ bank auditors! Post-PNB fraud, while most PSBs still have not dovetailed SWIFT into CBS (Core Banking System), some of them have belatedly begun the process once the few wild horses bolted from the stable taking their till! It goes without saying that the benefits of linking both systems are that all transactions are logged duly in the system and this would help calculate in metronomic precision the magnitude of liabilities! This way the integration enables banks to know that exposure limit set for a particular borrower is not crossed because CBS has all account details. This would also invest with banks involving in such cross-border transactions with greater controls so that no one could dare to game the system as it was done so deftly by Nirav Modi and his coadjutors in the conspiracy to milk the system so magnificently till the chickens have come home to roost and roast the ones who were caught while the main villains vanished from the country with their ill-gotten bounty to greener pastures to enliven the existence from the dreary drudgery of daily life here. In their wayward way, these fraudsters had the trust and solid faith of the common public in their sovereign banking industry torn to flinders.

The outbreak of insider frauds is on top of the disconsolate fact as conceded by the Minister of State for Finance in the post-budget session of Parliament in a written response that as on end-September, 2017, out of a total 21 PSBs, nine PSBs have gross non-performing assets (GNPAs) above 15 percent and 14 PSBs have GNPAs of more than 12 percent. In response to another query in the Lok Sabha on Feb 2, 2018, the minister said that there were 8,622 frauds in PSBs from 2014-15 to 2016-17 in which staff involvement was in 1,146 cases. It is not the number of the complicity of the internal staff that matters as in the case of the latest PNB case where a few employees recklessly defrauded the system in covert connivance with pushy tycoons who cared a hoot for the public money in gaming the system’s fail-prone process with unconcealed glee. It is also a recorded fact that as per RBI data on global operations, a mammoth sum of Rs 81,683 crore was written off (including compromise) by PSBs in the fiscal year 2016-17 with the cumulative write-off for the five year period ending March 31, 2017, amounting to a staggering Rs 2,49,926 crore. The whopping write-off of bad loans during the last five years must perforce have to be seen against the rescue package of 2.11 lakh crore of rupees that is recently announced to recapitalize the ailing banking system for the return to a normal practice of extending credit to real sectors of the economy to rev up growth.

At the end of the day, what is required is not a blame game or the facile option to privatize the PSBs stake so that private vigilance is par for the course. The government, bent upon ushering in a scam and corrupt-free governance, has the moral obligation to ensure that every institution that serves the public is ruthlessly rid of rotten elements so that public trust is restored and institutional integrity promoted for the development of the nation.

G. Srinivasan

©IPA Service

Photo from the Internet

#Vigilance #PNB #NiravModi #CBS #CBI #RBI #IPA #DifferentTruths

By

By

By

By