Financial frauds are perhaps as old as human civilisation. Tapati traces the antiquity of the swindle, as recorded in various ancient civilisations. Kautilya lists forty kinds of misappropriation of funds by the bureaucrats. Here’s to a better understanding of human nature – greed, avarice, and fraud – in the regular column, exclusively for Different Truths.

The morning on last Sunday, we were sitting with our smoking hot tea and newspaper serving equally hot news of one more massive fraud on the headline. The storm created by the defrauding of PNB by diamond jeweller Nirav Modi was yet to subside. Recently it has emerged that another Chennai-based jeweller has defrauded banks to the tune of 824 crores.

We have seen Vijay Mallya escape taking away Rs. 9000cr; Nirav Modi escaped with Rs. 11400cr and Rotomac owner, Kothari is absconding with 800cr of PSU banks money. The present case adds to this list of plunders.

Today’s morning paper disclosed of a Hyderabad based infra-structure company duping a consortium of eight banks to the tune of Rs.1394 crores.

My professor friend commented, “All have cleverly laid pre-planned intentions to cheat and defraud the banks.”

“It’s sickening to see our hard earned money being deducted as a tax is being looted from banks by malicious men without a single penny being recovered.”

“It is lack of moral values; uncontrollable personal greed is the motive behind these men…”

He handed over me a note scribbled on a ruled sheet, “Have a look at it and read through every line.”

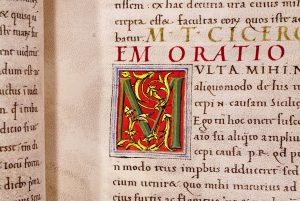

Cicero of the Roman Empire wrote this about the situation during his lifetime:

- The poor work & work.

- The rich exploit the poor.

- The soldier protects both.

- The taxpayer pays for all three.

- The wanderer rests for all four.

- The drunk, drinks for all five.

- The banker robs all six.

- The lawyer misleads all seven.

- The doctor, bills all eight.

- The undertaker buries all nine.

- The Politician lives happily on account of all ten.”

“What does it mean? This is a mirror reflection of what we are seeing around!”

“Cicero wrote it in 43 B.C., but valid even today.” He answered.

“Cicero?” I looked ignorant.

“Cicero was one of the leading political figures of the era of Julius Caesar”, he answered with a mischievous smile, a signal of his imminent lecture spiced with his knowledge of history.

“Yes, my friend, fraud and the fight against it can be traced back to the earliest writings.”

The concept of fraud is found in Greek mythology where Apate, the personification of deceit, perfidy, fraud, trickery, and dishonesty, is one of the evils contained in Pandora’s Box.

Fraud is found in the great civilisations of Antiquity though sufficient rules were also there to see that money swindling do not occur.

In Ancient Egypt, scribes were assigned to the monitoring of the pharaohs’ incoming and outgoing grain and gold inventories so as to prevent fraud and theft.

In Greek civilisation, Aristotle reports on the fraud surrounding the enactment of the Seisachtheia, or Solon’s shaking-off of burdens in the 6th century BC, which released the Greeks from slavery for debts.

In Roman times, Cicero’s Verrine Orations attest to the multiple thefts and the fraudulent collection of tax proceeds by Verres, the Governor of Sicily.

Think of the time of Kautilya; the state, even those days, exhibited a closely controlled and orderly financial accounting system.

The chancellor was responsible for collecting revenue from the whole country, along with his delegates, the Governor Generals in each city. It was his duty to prepare the budget and maintain detailed accounts of revenues and expenditures pertaining to all activities. The governors and record keepers in every city were to keep records of the number of people in each family, their gender, caste, family name, occupation, income and expenditures pertaining to all activities.

Manufacturing establishments also kept a stock register showing the purchases of all raw materials, the qualities of the same consumed in production, stock changes due to materials; and a manufacturing costs register showing expenditure on the labour employed and wages paid. In the case of stores of all kinds, the record books showed the prices, quality, quantity, and description of the containers in which these were stored.

The procedure of year-end Audit existed even then. Thus, all individuals and establishments involved in manufacturing, trading, retailing, and all such activities which engaged in monetary transactions were subject to audits and scrutiny. The Chief Controller and the auditor was responsible for the maintaining the record office where the accounts book showing, for each and every business establishments in the marketplace, the nature of its activity and total income received from it.

On the closing day for accounts, all the accounts officers were to present themselves with sealed accounts books and with the net balance of revenue over expenditure in sealed containers. The chief controller and auditor would have the accounts thoroughly audited by the audit officers, who would check the entries to verify net balances. The king would then be informed of the audit results.

Significantly, Kautilya was concerned, at least to some extent with accountability. For example, he recommended specifically the listing of revenue collected from fines paid by government servants and gifts. He also wrote, Expenditure will be classified according to the major heads, as prescribed.

He added that every official who is authorised to execute a task or is appointed as a Head of Department shall communicate [to the King] the true facts about the nature of the work, the income and the expenditure, both in detail and the total.

In fact, he believed in the virtuous cycle of good governance, riches, knowledge and ethical conduct.  Accordingly, Kautilya put a very heavy emphasis on good governance. Kautilya‘s definition of good governance consisted of provision of infrastructure and national security, formulation of efficient policies and their effective implementation and ensuring clean and caring administration.

Accordingly, Kautilya put a very heavy emphasis on good governance. Kautilya‘s definition of good governance consisted of provision of infrastructure and national security, formulation of efficient policies and their effective implementation and ensuring clean and caring administration.

Kautilya‘s insights into compliance issues are remarkable. According to him, ignorance of the work, neglect of duty, timidity, corruption, arrogance, and greed on the part of tax officials were the main factors for causing the loss of revenue. Clearly, Kautilya emphasised both honesty and efficiency.

He noted that it was not easy to detect corruption. He stated, ― just as it is impossible to know when a fish moving in water is drinking it, so it is impossible to find out when government servants in charge of undertakings misappropriate money.

He added, “It is possible to know even the path of birds flying in the sky but not the ways of government servants who hide their [dishonest] income.”

Kautilya suggested heavy penalties on those officials, who misappropriated revenue. He suggested: Those officials who have amassed money [wrongfully] shall be made to pay it back; they shall be transferred to other jobs where they will not be tempted to misappropriate and be made to disgorge again what they had eaten. On the other hand, according to Kautilya, ― an officer who accomplishes a task as ordered or better shall be honoured with promotion and rewards.

It appears that Kautilya did not mention any punishment for bribing. Since he considered the people more like victims. In fact, he suggested compensating them for their losses. So he wrote: A proclamation shall then be issued calling on those who had suffered at the hands of the [dishonest] official to inform. All those who respond to the proclamation shall be compensated according to their loss. That could be an effective way to combat corruption since the person, who is forced to bribe might be more than willing to provide some solid evidence against the corrupt officials.

“The current law by treating both the giver and the receiver of bribes as criminals unnecessarily protect the corrupt officials.” The professor took a short break. Sipping from next cup of tea, he shared details unknown to me.

“Can you imagine Kautilya lists forty kinds of misappropriation of funds by the bureaucrats? The  informant giving information on corruption was entitled one-sixth of the amount as a reward. There is also a fascinating description of how the departmental supervisors should check whether expenditures have been incurred for the desired end – including the heads (labor, capital, and material) of the expenditure.

informant giving information on corruption was entitled one-sixth of the amount as a reward. There is also a fascinating description of how the departmental supervisors should check whether expenditures have been incurred for the desired end – including the heads (labor, capital, and material) of the expenditure.

Kautilya identified the problem of moral hazard (i.e., the problem of shirking) and suggested payment of efficiency wages and supervision. He wrote: The king shall have the work of Heads of Departments inspected daily, for men are, by nature, fickle and, like horses, change after being put to work.”

I was awed with so much of information about financial regulation, bribery in the remote past.

With technological advancement and digital system of handling has made these dubious deals easier and spread faster. People leave the country after committing the crime and in a short time he lands in a safer zone. In fact, few safe havens are famous for breeding and hiding point of illegal financial deals. Our smart technology and intelligence system are not without loopholes. Here the dubious people slip through making fool of all officials and regularity systems.

After thousands of years, how we call ourselves civilised is the question came propping up in my mind, especially in this situation of huge public money being siphoned off. These are huge amounts, especially in a country like ours where poverty shows across the land and farmers commit suicide for not being able to repay meager thousands of rupees loans.

©Tapati Sinha

Photos from the Internet

#FraudsInHistory #GovernmentAndFrauds #AgeOldFinanacialFrauds #HistoryOfFinancialFrauds #NowAndThen #DifferentTruths

By

By

By

By