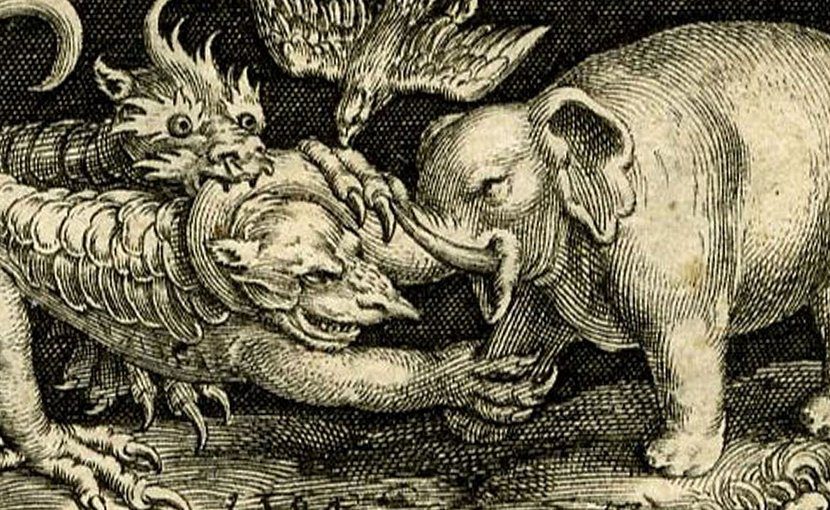

India’s share in world trade is stuck at around 1.8 percent since 2011, whereas that for China is close to 12 percent. For the Indian elephant to catch the Chinese dragon at the halfway mark by 2020, the export figure needs to grow in excess of 30 percent annually. Indeed, a hard task at hand. An in-depth analysis, for Different Truths.

When it comes to competing in the world economy, the Chinese dragon always wins hands down against the Indian elephant. India’s share in world trade is stuck at around 1.8 percent since 2011, whereas that for China is close to 12 percent. For the Indian elephant to catch the Chinese dragon at the halfway mark by 2020, the export figure needs to grow in excess of 30 percent annually. Indeed, a hard task at hand.

Now it appears India has found a true friend in ASEAN. The day of reckoning from look east to act east has finally arrived as India hosted 10 leaders from ASEAN region as chief guests for the 2018 Republic Day parade. For India, hoping to grab 5 percent share of global trade by 2020, it is important that New Delhi nurture this friendship with the ASEAN region.

Now it appears India has found a true friend in ASEAN. The day of reckoning from look east to act east has finally arrived as India hosted 10 leaders from ASEAN region as chief guests for the 2018 Republic Day parade. For India, hoping to grab 5 percent share of global trade by 2020, it is important that New Delhi nurture this friendship with the ASEAN region.

Although the focus of the meeting is on maritime cooperation and security, trade and investment flows are important. Between 2008 and 2016, India’s trade with ASEAN region has increased faster than two of its two largest trading partners, namely, European Union and the United States. The two-way trade between India and ASEAN has moved from $65.1 billion in 2015-16 to $71.6 billion in 2016-17. However, this figure is meager in comparison to China’s $452.3 billion in 2016.

Over the last 15 years, China has emerged as first or second largest trading partner with almost all Southeast Asian countries. Where China succeeded and India failed is about building connectivity and institutional linkages with the ASEAN counterpart. For India, a strong relation with ASEAN is important for five reasons. First, as the cost of production is lower in Laos, Cambodia, and Myanmar, it means that Indian firms can gain significantly by investing in these countries. Second, investing in these regions meant a bigger market for Indian firms. ASEAN region has a combined GDP of $2.7 trillion. Third, Indian firms can evade protectionist measures (read the Trump factor) targeted against their exports if they started exporting from ASEAN region. Fourth, investing in these regions will also ease out some of India’s energy requirements, enabling Indian companies to access cheaper foreign energy (oil and power) and minerals from Cambodia, Myanmar, and Vietnam. Fifth, and more importantly, participating in the South-East Asian production network will enable India to increase its manufacturing base besides creating jobs for its young population.

Each year around 12 million people enter the labour force in India when roughly 2 million jobs get created. Economically well-off ASEAN nations, such as Brunei, Singapore, Malaysia, and Thailand, can gain from making use of India’s cheap labour. In recent times, labour costs in China have increased substantially, and India can take advantage of that. Thanks to the strengthening of yuan, Chinese labour costs are now only 4 percent cheaper than those in the US. Average wages in China’s manufacturing sector have surpassed that of Brazil and Mexico, and are fast catching up with Greece and Portugal. This is in contrast to India, where manufacturing wages have flattened since 2010 at just $1 an hour.

Each year around 12 million people enter the labour force in India when roughly 2 million jobs get created. Economically well-off ASEAN nations, such as Brunei, Singapore, Malaysia, and Thailand, can gain from making use of India’s cheap labour. In recent times, labour costs in China have increased substantially, and India can take advantage of that. Thanks to the strengthening of yuan, Chinese labour costs are now only 4 percent cheaper than those in the US. Average wages in China’s manufacturing sector have surpassed that of Brazil and Mexico, and are fast catching up with Greece and Portugal. This is in contrast to India, where manufacturing wages have flattened since 2010 at just $1 an hour.

There are also other elements of complementarities. India’s nuclear power plant is yet to become fully operational. The energy source, particularly hydroelectric power generation on the Mekong River, can be of use to the booming and fuel hungry economy of India. Similarly, electric power generation in India is mainly coal-based. Indonesia possesses the largest and most easily accessible coal reserve in the ASEAN region. Malaysia sits on huge natural gas reserves. Vietnam is a major exporter of oil. All this can help India, which can gain by becoming a partner for the proposed Trans-ASEAN pipeline project. The project aims to develop a regional gas grid by 2020, by linking the existing and planned gas pipeline networks of the ASEAN member states.

Indian companies too can realign their resources to tap the region’s potential. Companies such as Larsen & Toubro, Adani Port, and NTPC Limited can invest in Myanmar with money and technical expertise to build infrastructures, such as building container dock and coastal ships, power stations, and cement factories. Indian telecommunication companies, such as Bharti Airtel and Reliance, have the expertise for laying optical fiber cables and telecommunication network, something in need for countries such as Myanmar, Cambodia, and Laos. Indonesia offers a huge investment opportunity for Indian oil exploration and construction firms, such as Oil and Natural Gas Corporation Limited.

Indian companies already have many joint ventures with their Indonesian and Singaporean counterparts. For example, Bajaj Auto has a joint venture for the assembly and production of three and two-wheelers. Tata Motors has a manufacturing facility in Thailand. In fact, Tata group with 16 companies has designated Singapore as its regional hub. Other Indian companies with significant investment in Indonesia include Aditya Birla Group (Indo-Bharat Rayon), S. P. Lohia Group (Indo-Rama Synthetics), Ispat Group (Ispat-Indo), and Essar Group (Essar Dhananjaya).

A robust Indio-ASEAN relation will also open up the opportunity for people to people contact. India has an abundant supply of skilled professionals in areas related to computer and information services, other business services such as financial, medical tourism, insurance, etc., and movement of natural persons such as IT professionals and seafarers. The rise of e-commerce, especially in economies like Malaysia and Thailand, presents an opportunity for Indian IT firms. Similarly, India offers a great place for medical tourism and education, something that ASEAN counterpart can make use of.

However, to keep this India-ASEAN relation on track, it is worthwhile to take into cognizance the bugs. There are many export items – of interest both to India and ASEAN – which are in negative lists; with trade not permitted. A conscious decision is needed to reduce the number of non-tariff barriers such as the imposition of anti-dumping measures and phytosanitary sanctions. Similarly, to facilitate labour movement between India and ASEAN it is essential to have institutions for mutual recognition of standards in India-ASEAN bilateral services agreements. For example, in spite of India having a services trade agreement with Japan, Indian nurses, architects, and even yoga professionals are yet to get a market entry. Likewise, agreement with South Korea that allows Indian engineers, consultants and other professionals to go and work in South Korea is met with limited success, with recognition of Indian engineering colleges remaining an issue.

However, to keep this India-ASEAN relation on track, it is worthwhile to take into cognizance the bugs. There are many export items – of interest both to India and ASEAN – which are in negative lists; with trade not permitted. A conscious decision is needed to reduce the number of non-tariff barriers such as the imposition of anti-dumping measures and phytosanitary sanctions. Similarly, to facilitate labour movement between India and ASEAN it is essential to have institutions for mutual recognition of standards in India-ASEAN bilateral services agreements. For example, in spite of India having a services trade agreement with Japan, Indian nurses, architects, and even yoga professionals are yet to get a market entry. Likewise, agreement with South Korea that allows Indian engineers, consultants and other professionals to go and work in South Korea is met with limited success, with recognition of Indian engineering colleges remaining an issue.

Nilanjan Banik

(The author is Professor, Bennett University, Greater Noida).

©IPA Service

Photos from the Internet

#ASEAN #SouthKorea #Japan #AdityaBirlaGroup #Myanmar #China #ChineseDragon #IndianElephant #Chao #Indonesia #Singapore #MekongRiver #Vietnam #IPA #DifferentTruths

By

By