The Narendra Modi government’s oil policy has been so convoluted that it punishes the consumers when international crude oil prices move both ways. When prices go up, the dynamic pricing ensures that the increase is passed on to the consumers. But dynamic pricing ceases to apply the moment crude prices start coming down. Any price fall is taken as an opportunity to raise taxes so that consumers continue to pay the higher prices. So dynamic pricing has become another government-sponsored Ponzi scheme. A report, for Different Truths.

Finance Minister Arun Jaitley’s warning that petrol and diesel prices in the country have to stay high as long as Indians don’t pay their taxes smacks of arrogance and his tone is that of a British viceroy sermonising to the natives about the virtues of honesty and loyalty to the Crown.

“The tragedy of the honest taxpayer is that he not only pays his own share of taxes but also has to compensate for the evader,” Jaitley said. “My earnest appeal, therefore, to political leaders and opinion makers is that the full and complete suggestion would be that evasion in the non-oil tax category must be stopped and, if people pay their taxes honestly, the high dependence on oil products for taxation eventually comes down.” He is virtually calling upon people to ensure greater tax compliance.

The burden of his argument is that since people don’t pay tax, the government has no option but to keep raising tax rates on items such as petrol and diesel, where there is no scope for evasion as the tax is built into the price. For the benefit of those who are less brainy, he explained it further: Better compliance would reduce the dependence on tax collections from petroleum products.

Now, whose responsibility is it to ensure tax compliance if it is not his and his government’s? He is simply dodging the issue by passing the buck to the public. It is the government’s duty to ensure tax compliance as it has all the means required for it. It has the law in hand, the machinery to enforce the law and the powers, by virtue of majority in Parliament, to create the right law if the existing ones are found to be lacking in any respect. If he and his government have failed in doing that, he cannot blame the people. In fact, he is charging the Indian people a premium for his own ineptitude.

Jaitley cannot be more right in saying that only the salaried class pay their taxes properly because there is no scope for evasion there. The fact of the matter is that, despite coming to power promising better governance and eradication of black money, his government, like all other governments, is hand in glove with the big tax offenders, as they are the ones who keep filling the coffers of the political establishments. He and his government do not have the gall to move a finger against them.

Wisecracking on ‘his distinguished predecessor’ Chidambaram’s suggestion that the government can actually reduce the tax on petrol price by Rs 25 per litre, Jaitley says it is a ‘trap’ intended to push India into unmanageable debt. It surely is a trap, but set for the incumbent finance minister and not the people of India, as is made out. Does he expect Chidambaram to do anything else?

Jaitley has put forward another wonderful theory that the states have benefited from higher petrol and diesel prices. Since states charged ad valorem taxes on oil, and so if oil prices rise, the states earned more, he pointed out. If this is the way to earn revenue for the government, why stop at the current levels? The government can increase the taxes further; the industry will then charge it from the consumers and consumers can think of other ways to earn more, including ever more ingenious methods to evade taxes. It will be a nice Ponzi scheme and since it is run by the government, no questions will be asked.

It is high time someone brought it to the attention of our finance ministers that earning revenue through taxation is no substitute for the creation of wealth for the nation, which is the primary function of any government. For this to happen, the government must ensure the conditions to create more wealth and claim a share of such wealth to find resources to run the government. Levying taxes is certainly one good option, but that cannot be the only way to mobilise resources for the government.

The Narendra Modi government’s oil policy has been so convoluted that it punishes the consumers when international crude oil prices move both ways. When prices go up, the dynamic pricing ensures that the increase is passed on to the consumers. But dynamic pricing ceases to apply the moment crude prices start coming down. Any price fall is taken as an opportunity to raise taxes so that consumers continue to pay the higher prices. So dynamic pricing has become another government-sponsored Ponzi scheme.

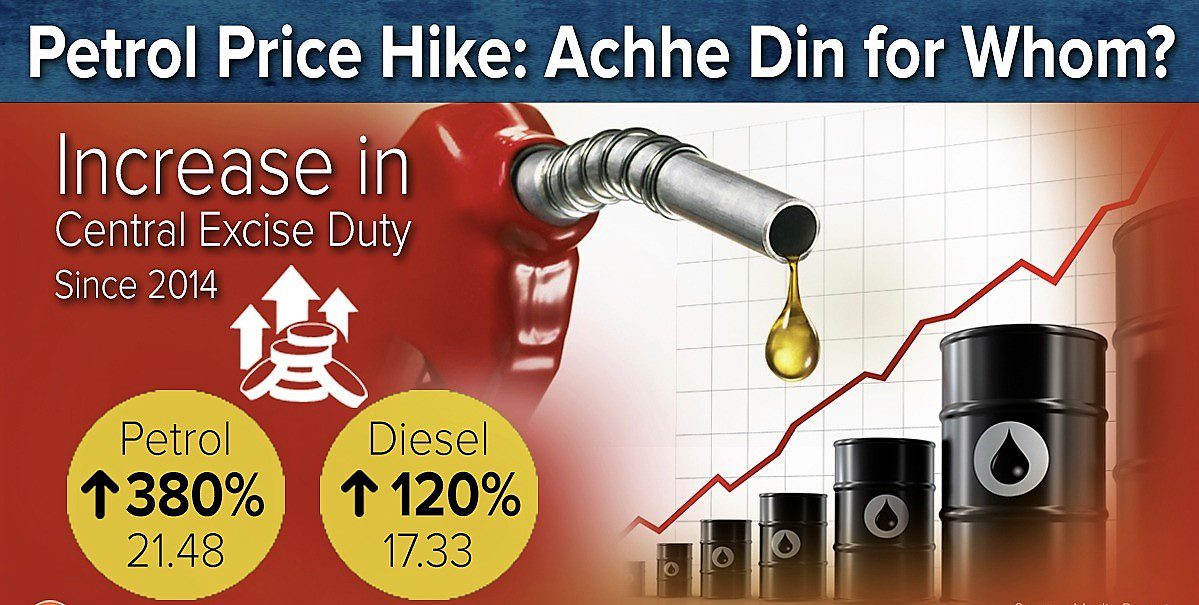

Since 2014, when international crude prices sank to $46 per barrel after touching a peak of $132 in 2008, tax on petrol and diesel has been revised 11 times. From Rs 3.56 per litre, the excise duty on diesel was raised to Rs 17.33 per litre, an increase of over 380 percent in three years. In the case of petrol, the increase was of over 120 percent, going up from Rs 9.48 per litre to 21.48 per litre. At least on four occasions, the tax increase was two rupees and more, while global prices were continuously on a downtrend. Taxes and duties now exceed the production cost by over 100 percent. That also shows the extent of cruelty perpetrated by the government against Indian public.

K Raveendran

©IPA Service

Photos from the Internet

By

By

By

By